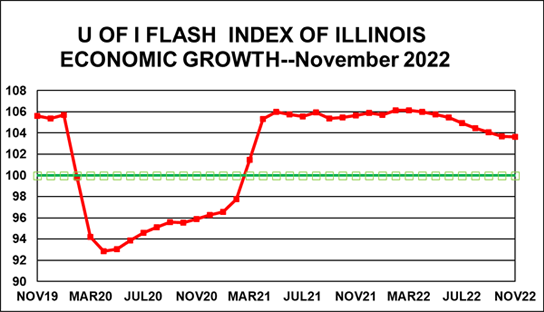

Urbana – After seven months of decline, The U of I Flash Index for November remained steady at 103.7 compared to October’s reading.

“This is based on the continued strong performance of Illinois state revenues. Uncertainties about Illinois and national economies continue to be a concern. This centers on how aggressive the Federal Reserve will be in its efforts to quell inflation. As mentioned last month, the data are consistent with either a soft landing (a slowing economy without a recession) or a modest downturn.”

Giertz said the positive signs include the expectation that the Fed will not increase interest rates as much as assumed a few months ago, the partial recovery of equity markets (that are forward-looking) after their recent steep declines, and the continued strength of employment. However, the inflation problem and the Fed’s response is not resolved. The Fed has indicated the willingness to pursue its tight money policy even at the cost of slower growth. The housing market including residential construction has slowed significantly and the fiscal stimulus of the Covid crisis is waning.

The Illinois unemployment rate inched up to 4.6% from 4.5% the previous month, but it is below the 5.3% level of one year ago.

“This is surprisingly low given the concern about the economy, but Illinois’ rate is still well above the 3.7% rate, ranking last (highest) among the states.”

“Illinois revenues remained strong with all three basic tax revenue sources (the income, corporate, and sales taxes) growing in real terms compared to the same month last year. Corporate tax receipts were especially strong.”

The Flash Index is a weighted average of Illinois growth rates in corporate earnings, consumer spending, and personal income as estimated from receipts for corporate income, individual income, and retail sales taxes. These revenues are adjusted for inflation before growth rates are calculated. The growth rate for each component is then calculated for the 12-month period using data through November 30, 2022. Two and one-half years since the beginning of the COVID-19 crisis, ad hoc adjustments are still needed because of the timing of the tax receipts resulting from state and Federal changes in payment dates.

“Illinois revenues remained strong with all three basic tax revenue sources (the income, corporate, and sales taxes) growing in real terms compared to the same month last year. Corporate tax receipts were especially strong.”