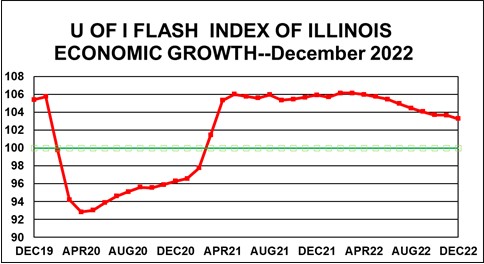

Urbana – After a one-month reprieve, the U of I Flash Index for December continued its slow decline that began in May, falling to 103.3 compared to 103.7 for November.

The lower index reading does not mean the Illinois economy is contracting because any reading above 100 indicates growth.

“In retrospect, 2022 could be characterized as a year on the brink, but with no real resolution. The unanswered question is the ultimate destination for the Illinois and national economies: recession or soft landing.”

Giertz said the economic signs remain ambiguous. Quarterly GDP was down in the first two quarters of 2022 but increased in the third quarter with forecasts suggesting another increase in the fourth quarter. Employment remained strong with unemployment low compared to usual recessionary levels. Illinois’ rate was 4.7%, compared to 5.1% a year ago. Inflation remains high but appears to be moderating from the peak levels earlier in the year. The Federal Reserve continues its tight monetary policy, which has dampened the housing sector.

“Illinois state tax revenues (the basic building blocks of the Flash Index) continue to hold up well. For calendar 2022, corporate tax receipts were up by more than one-third after adjusting for inflation, individual income taxes were up by over 8% while sales tax revenues fell slightly in real terms. Monthly revenues for December compared to the same month last year (in real terms) were up for corporate taxes, but sales and individual tax receipts were down slightly.”

The Flash Index is a weighted average of Illinois growth rates in corporate earnings, consumer spending, and personal income as estimated from receipts for corporate income, individual income, and retail sales taxes. These revenues are adjusted for inflation before growth rates are calculated. The growth rate for each component is then calculated for the 12-month period using data through November 30, 2022. Two and one-half years since the beginning of the COVID-19 crisis, ad hoc adjustments are still needed because of the timing of the tax receipts resulting from state and Federal changes in payment dates.

“Illinois state tax revenues (the basic building blocks of the Flash Index) continue to hold up well. For calendar 2022, corporate tax receipts were up by more than one-third after adjusting for inflation, individual income taxes were up by over 8% while sales tax revenues fell slightly in real terms."