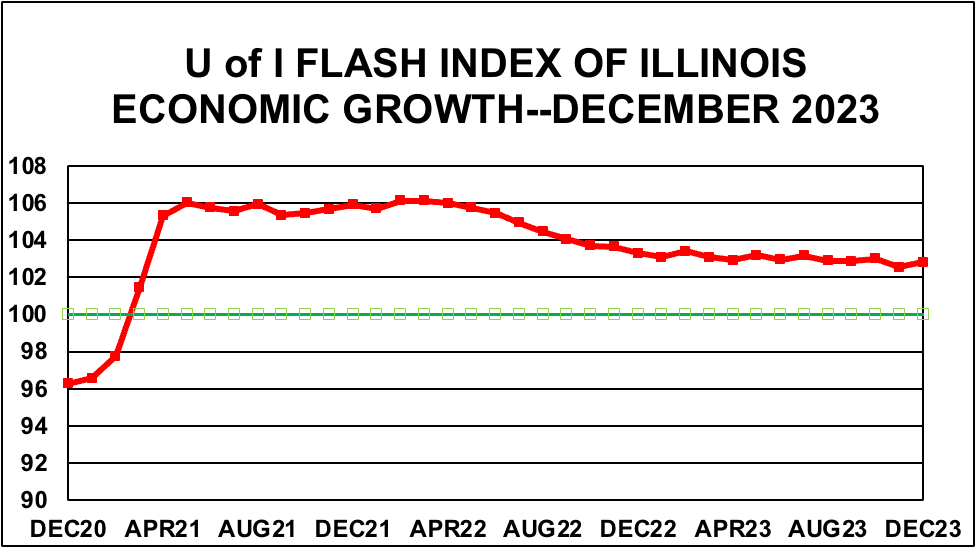

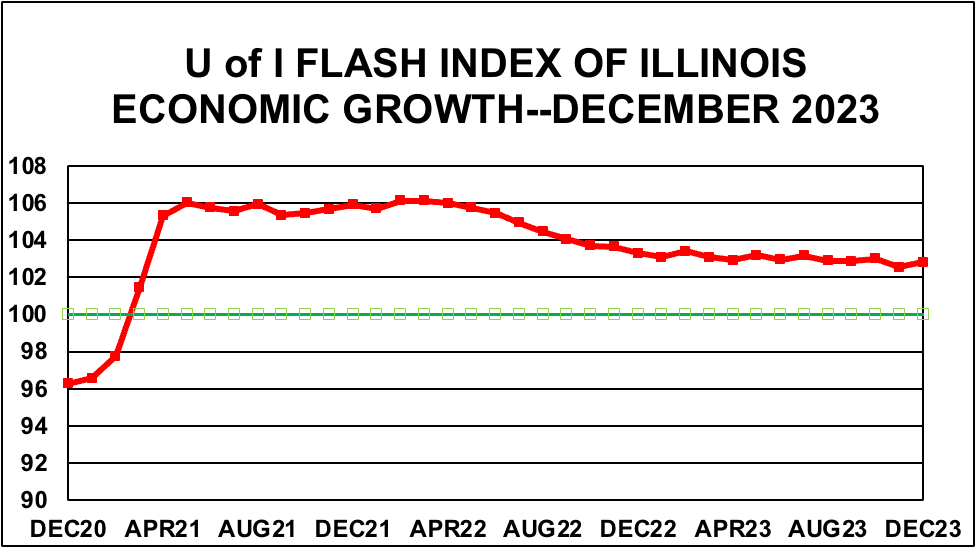

The U of I Flash Index for December 2023 increased slightly to 102.8 from its 102.6 reading in November. The index for calendar 2023 remained in a tight range around the 103 level—reflecting stability in a period of overall turmoil.

“Uncharacteristically, the Illinois and U. S. economies were remarkably steady amid troubling events including the attacks in Gaza and the aftermath, the continuing war in Ukraine, the unresolved border crisis in the U. S., and the political woes of a dysfunctional Congress and the prospect of another divisive presidential election.”

“On the economic front, 2023 was a period of surprisingly good news. Inflation receded without (as yet) the much-anticipated recession—the ‘soft landing.’ Someone once suggested that former Federal Reserve Chair Alan Greenspan was either very good or very lucky during his tenure. It appears the same can be said (at least so far) about current chair Jerome Powell with the soft landing that few believed possible.”

Unemployment has remained low in Illinois and the nation. Illinois and the national unemployment rates (4.7% and 3.7%, respectively) were one-tenth of a percentage point above the levels one year ago. GDP growth for the period remained strong as well. Equity markets showed significant gains for the year after a lackluster 2022.

Illinois income tax receipts were strongly positive for the month compared to the same month last year after adjusting for inflation while sales tax receipts decreased slightly. Corporate tax receipts were down sharply, largely because December 2022 revenues were so large.

The Flash Index is a weighted average of Illinois growth rates in corporate earnings, consumer spending, and personal income as estimated from receipts for corporate income, individual income, and retail sales taxes. These revenues are adjusted for inflation before growth rates are calculated. The growth rate for each component is calculated for the 12-month period using data through December 31, 2023. Since the beginning of the COVID-19 crisis, ad hoc adjustments are still needed because of the timing of the tax receipts resulting from state and Federal changes in payment dates in recent years.

These adjustments will be phased out in 2024.