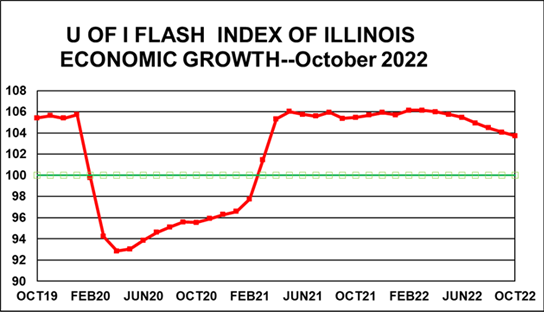

Urbana – The U of I Flash Index for October fell again to 103.7 compared to the 104.1 reading in September. This marks the seventh straight month of decline since the Index reached a post-recession peak of 106.1 in March of this year.

The lower index reading does not mean the Illinois economy is contracting because any reading above 100 indicates growth.

“This is a clear slowing of the Illinois economy, but it must be remembered that the 100-level is the dividing line between growth and decline. The obvious question is whether the U. S. and Illinois economies are heading for a recession. So far, the results are consistent both with a soft-landing (a slowing without a decline) and a recession with the probability of a recession increasing somewhat.”

Giertz said the uncertain economic indicators continue. Third quarter GDP was up by 2.3% after two-quarters of decline and the unemployment rate remains low. However, the Illinois rate of 4.5% was one percentage point above the national average, giving Illinois the nation’s highest rate. The equity markets have rebounded modestly after a steep decline with investors encouraged by the prospect of the Fed pursuing a somewhat slower tightening of monetary policy. However, the basic economic concerns of inflation and higher interest rates continue with consumer spending slowing and the housing market declining after surprising growth.

Illinois’ revenues (the basis of the Flash Index) remain strong with monthly year-to-year increases (after adjusting for inflation) in individual income tax and corporate tax receipts, but with sales tax receipts trailing inflation.

“However, the unexpectedly strong revenue growth of the past two years is returning to a more normal pattern”

The Flash Index is a weighted average of Illinois growth rates in corporate earnings, consumer spending, and personal income as estimated from receipts for corporate income, individual income, and retail sales taxes. These revenues are adjusted for inflation before growth rates are calculated. The growth rate for each component is then calculated for the 12-month period using data through October 31, 2022. After more than two years since the beginning of the COVID-19 crisis, ad hoc adjustments are still needed because of the timing of the tax receipts resulting from state and Federal changes in payment dates.