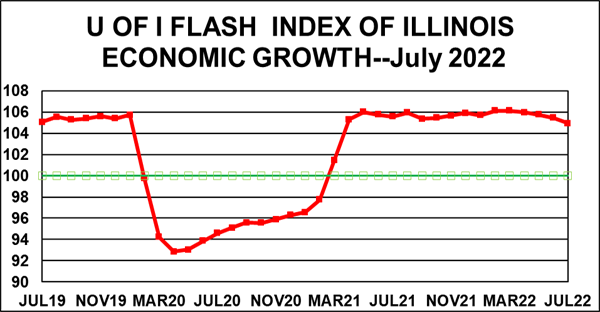

Urbana – The U of I Flash Index for July declined significantly, falling to 104.9 from its 105.5 reading in June.

“The contradictory economic indicators continue with negative growth in the U. S. GDP the last two quarters (based on preliminary estimates) and slowing growth of Illinois tax receipts accompanied by still low unemployment rates both nationally and in the state with a high level of inflation,” said University of Illinois economist J. Fred Giertz, who compiles the monthly index for the Institute of Government and Public Affairs. “It should be noted that a slowing index does not mean the Illinois economy is in decline since a reading above 100 indicates growth.”

Giertz indicates that this situation has been characterized as a supply-induced slowdown as compared to the usual one resulting from deficient demand. This is explained by the Federal Reserve’s imposition of tighter monetary policy to address inflation concerns along with waning federal stimulus activity and continued supply chain issues exacerbated by the war in Ukraine.

“Illinois tax revenues are returning to a more normal pattern after more than two years of unexpectedly robust growth during the recovery from the Covid crisis. Individual income tax and sales tax receipts have not kept pace with inflation over the last three months while corporate tax receipts remain strong.”

The question at hand is whether the economy is in a recession. A recession is traditionally determined after the fact by the National Bureau of Economic Research, a respected private research group. While recessions are often defined as two-quarters of negative growth, the actual recession call is a more complex decision, especially in the current environment with both slowing growth and low unemployment. Clearly, the risk of a recession has increased, but it is too early to label this a recession.

The Flash Index is a weighted average of Illinois growth rates in corporate earnings, consumer spending, and personal income as estimated from receipts for corporate income, individual income, and retail sales taxes. These revenues are adjusted for inflation before growth rates are calculated. The growth rate for each component is then calculated for the 12-month period using data through July 31, 2022. After more than two years since the beginning of the COVID-19 crisis, ad hoc adjustments are still needed because of the timing of the tax receipts resulting from state and Federal changes in payment dates.